How research can help brands reconnect with their customers

07 January, 2019 Reading: 5:11 mins

Consumer goods giants like Proctor & Gamble typically spend a year or two researching consumer attitudes before they launch a new product. Coca-Cola and McDonald’s are also well known for the quality of their research.

Some of the most successful companies in the world have got to where they are because they invest so heavily in research before they bring any new product to market.

Consumer goods giants like Proctor & Gamble typically spend a year or two researching consumer attitudes before they launch a new product. Coca-Cola and McDonald’s are also well known for the quality of their research.

Unilever conducted in-depth exploration into women’s attitudes towards traditional advertising for beauty products before launching its ‘Real beauty’ campaign for Dove in 2004. The research revealed that 70 per cent of women didn’t feel represented in advertising, with almost as many admitting that the pressure to look like women they see in the media made them feel anxious, giving the ‘Real beauty’ campaign its emotional pull. Fourteen years later, these findings still inform Dove’s branding.

Revealing human truths

As a researcher, I can often spot when an advert has been based on in-depth consumer research, because it will contain human truths. The McDonald’s ‘The moment they surprise you’ advert was on when I was watching TV with my wife a few weeks ago. It shows a father taking his little girl out swimming – he’s looking out for her in the pool, helping her put her jacket on and so on. Then when they get to McDonald’s, he can’t work the new digital ordering screens so it’s his daughter’s turn to take charge.

My wife said: “Ahh, that’s really clever.” Yes it is – but it didn’t happen by accident. As a researcher, I can tell straight away that there was some focus group work undertaken to support this ad, where families were asked: “What does McDonald’s mean to you?” and McDonald’s would eventually have built up its campaign from those findings. Good focus groups provide really rich data.

But in the last ten years, research budgets have diminished, leading some brands to think they can do a “quick and dirty” survey and a few short interviews and that this will be enough. So you’ll see new consumer beauty products launched that claim to be research based, but they’ve actually only used a small sample and the research has not been very in depth. It’s also becoming clearer that organisations have a tendency to rely solely on insight from Mintel, instead of talking to their customers and gaining really valuable qualitative insight.

The value of good research

At KISS, we really want to educate people about the value of good research. We do internal audits for our clients, looking at competitors and the market as a whole. Then we carry out stakeholder interviews, both internal and external. It’s always interesting to see the difference between internal views and external views of a company or its products. Sometimes the senior people in an organisation can’t articulate what their brand stands for, because they’re so close to it. We need to talk to their customers to bridge the gap.

There can be a huge disharmony between internal and external views. This could be because your audience is going in a different direction to you or you’re focusing on the wrong part of your brand – or it could be for other reasons. Whatever the reason is for the disharmony, there’s a lot of work to be done when this happens and the results will inform the organisation’s strategy.

Senior management teams can find the idea of research quite intimidating – they often want the research to validate what they are already doing, and that’s only natural. It can be particularly difficult for new business owners, because it’s their baby and it’s difficult for them to be objective. But for organisations that are ready to embrace the results of research, the returns can be huge.

There’s a strong correlation between the amount of investment in research and the subsequent ROI in terms of sales. The more you spend, the more people you talk to and the more diverse your audience will be. You capture views from all of your stakeholders and distil that down to the human truths, which means that every element of comms you create resonates with your customers and they “get you” as a brand.

Using research to inform strategy

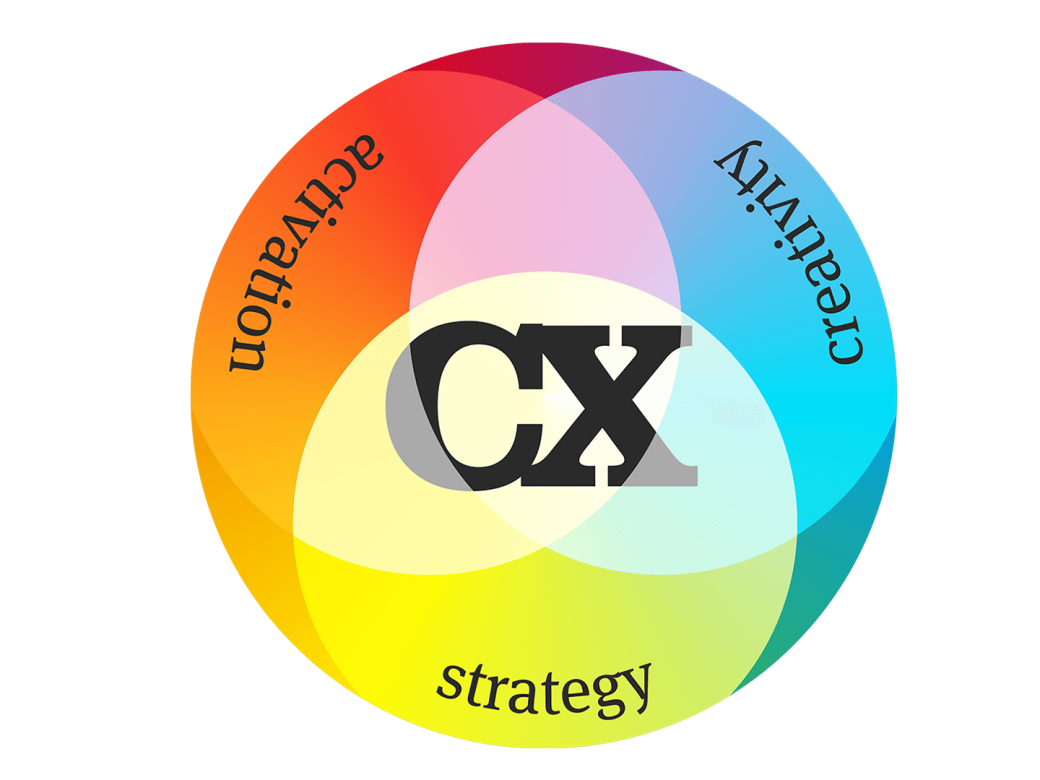

At KISS, we talk about our process of “Strategy, creativity, activation”, and when I do research for clients, the research phase is part of our immersive strategic work – marketing guru Mark Ritson calls it “disgnosis”. What clients want is insightful, focused and tangible research, which has a specific purpose and allows an element of exploration. Sometimes you need to take a step back and ask your customers: “What’s been happening over the last ten years and where do we fit?”

Understanding your audience’s true feelings, and the real human truth behind them, is what good strategy is based on. From that you get the briefing for the creative team and then you’ve got a great piece of branding or advertising that captures what the market is looking for.

So what could research mean in the context of your organisation? Typically, it would mean carrying out stakeholder interviews with individuals inside and outside the organisation. Using a combination of quantitative and qualitative research is really powerful. Surveys can provide some thought-provoking statistics and focus groups can really draw out some interesting opinions from different types of customers or user groups.

And you don’t need to have a research budget the size of Proctor & Gamble or Unilever to carry out meaningful research! KISS has worked with SMEs and membership organisations that want to understand more about their audience as part of a rebranding exercise or before launching a new campaign.

To find out more about what KISS could do to help you, drop us a line.